DVM View: Making L1s great again. Sonic is capturing lots of attention, with $S rebounding 163% in the past 3 days, and nearly regaining prior ATHs – making it one of the most reflexive tokens in all of crypto. We think discounted valuation multiples will expand towards (and potentially above) peers overtime driven by on-going share gains and $AAPL-like revenue fly-wheel model.

Key Points:

- The recent outperformance of $S reflects a bevy of positive fundamental data with fees, TVL, and usage all up 1000x%+ from 30 days ago as the ecosystem and network ramp.

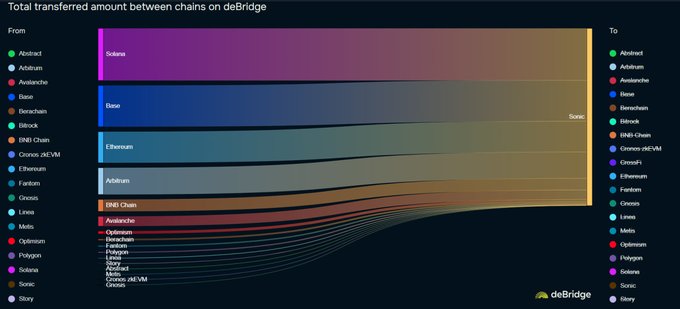

- In the past 7 days, there has been ~$38m of inflow to Sonic from other networks according to @deBridgeFinance

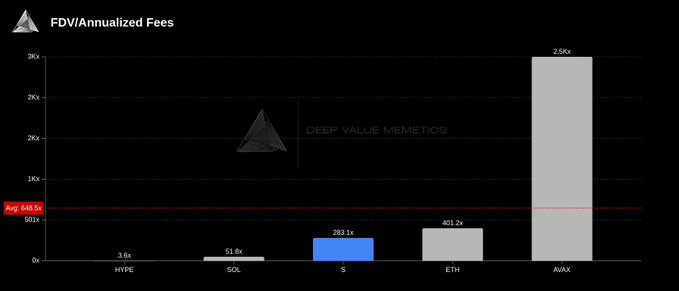

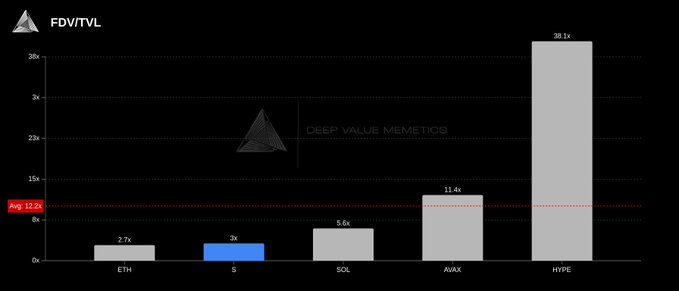

- Valuations are materially discounted to peer group. On a FDV/fees basis, $S trading at ~60% discount to peers ( $ETH, $SOL, $AVAX, $HYPE ); using FDV/TVL valuation is trading ~75% below peers ( $ETH, $SOL, $AVAX, $HYPE ).

- $S is well-positioned to take market-share given $AAPL-like revenue model (10% fee on apps), ~$200m Innovator Fund, and speed of development.

- On-going execution and market share capture in the L1 space could drive $S towards $10b+ as valuation multiples expands reflecting growth.

- For reference, $FTM (aka v1 of $Sonic) achieved an ATH of ~$11b last cycle in Oct, 2021.

Quick Overview

Sonic, developed by Sonic Labs and OG @AndreCronjeTech, is an Ethereum Virtual Machine (EVM)-compatible Layer 1 blockchain designed to deliver unparalleled speed, robust incentives, and world-class infrastructure for DeFi. Launched in December 2024 as a rebrand of $FTM, Sonic has quickly emerged as a standout player in the blockchain space, boasting 10,000 transactions per second with sub-second finality, a thriving ecosystem, and explosive growth metrics.

FDV/Fee Ratio of 283x is 57% below vs. Peers ( $SOL, $AVAX, $ETH, $HYPE ): Sonic recognizes fees by collecting 10% of app revenues. Given the growth, we back into estimated annualized fees using last 7 day fees of ~$209k (assuming $830k fees per month), using data from @DefiLlama This compares to peers:

FDV/TVL Ratio of 3.0x is 75% below peers ( $SOL, $AVAX, $ETH, $HYPE ): Sonic’s TVL is $936m, resulting in an FDV/TVL ratio of 3.0x, notably lower than group average of 12.2x.

Total onchain transferred amounts to Sonic: 24h inflows were +$9.5m, 7d inflows were +$38m, 30d inflows were +$63m.

Over 30 days, Sonic ranked fifth for inflows, totaling $63m, with $19.7m from Solana, $17.4m from Base, and $9.5m from Ethereum. In the last seven days, it held fifth place with $38m in inflows, including $11m from Solana, $9m from Base, and $7m from Ethereum. In the past 24 hours, Sonic rose to second, attracting over $9.5m in on chain transfers.

Source: https://app.debridge.finance/analytics

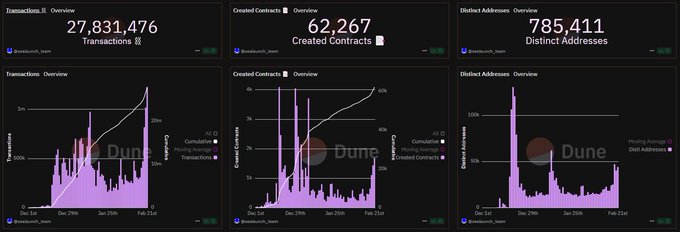

Transactions +140x, and Distinct Addresses +2x Since Beginning of Month.

Sonic is currently handling 28m Total Transactions, up 140x, from 200k at the beginning of the month. Similarly, total distinct addresses are at 786k, as new addresses are currently 47k, up 176%, from 17k at the beginning of the month according to @Dune

Source: https://dune.com/sealaunch/sonic

Ecosystem Accelerating Given Fee Structure and Innovator Fund.

-Fee Monetization: Developers earn up to 90% of app-generated fees, driving projects like Shadow Exchange (30%+ of transactions, $119M TVL) and Silo Finance ($310M total supply in lending).

-Innovator Fund: Up to 200m $S tokens support app onboarding and new ventures.

-Airdrop: Approximately 200m $S tokens incentivize users from both Fantom Opera and Sonic.

-Key Players: Shadow Exchange ($73m+ TVL, $772m volume), Odos Protocol (10% of fees), and gaming app

-Sacra: Falling of Myrd (25%+ of fees) highlight diversity beyond DeFi.

Technology (Speed) | Sonic’s technical prowess sets it apart as the highest-performing EVM L1.

-Performance: Achieves 10,000 TPS with sub-second finality (recent block time: 0.4 seconds vs. 2.95 seconds in December 2024).

-Consensus: Uses Asynchronous Byzantine Fault Tolerance (ABFT) with Directed Acyclic Graphs (DAGs) and Proof of-Stake (PoS), enabling validators to process transactions concurrently, avoiding bottlenecks seen in sequential blockchains like Bitcoin.

-Storage: Live pruning optimizes validator efficiency by discarding historical data in real-time, reducing costs without downtime.