“History doesnt repeat itself but it oftens rhymes.” Recall, on March 22nd 2018 Trump announced tariffs on Chinese goods, which totaled $50b.”

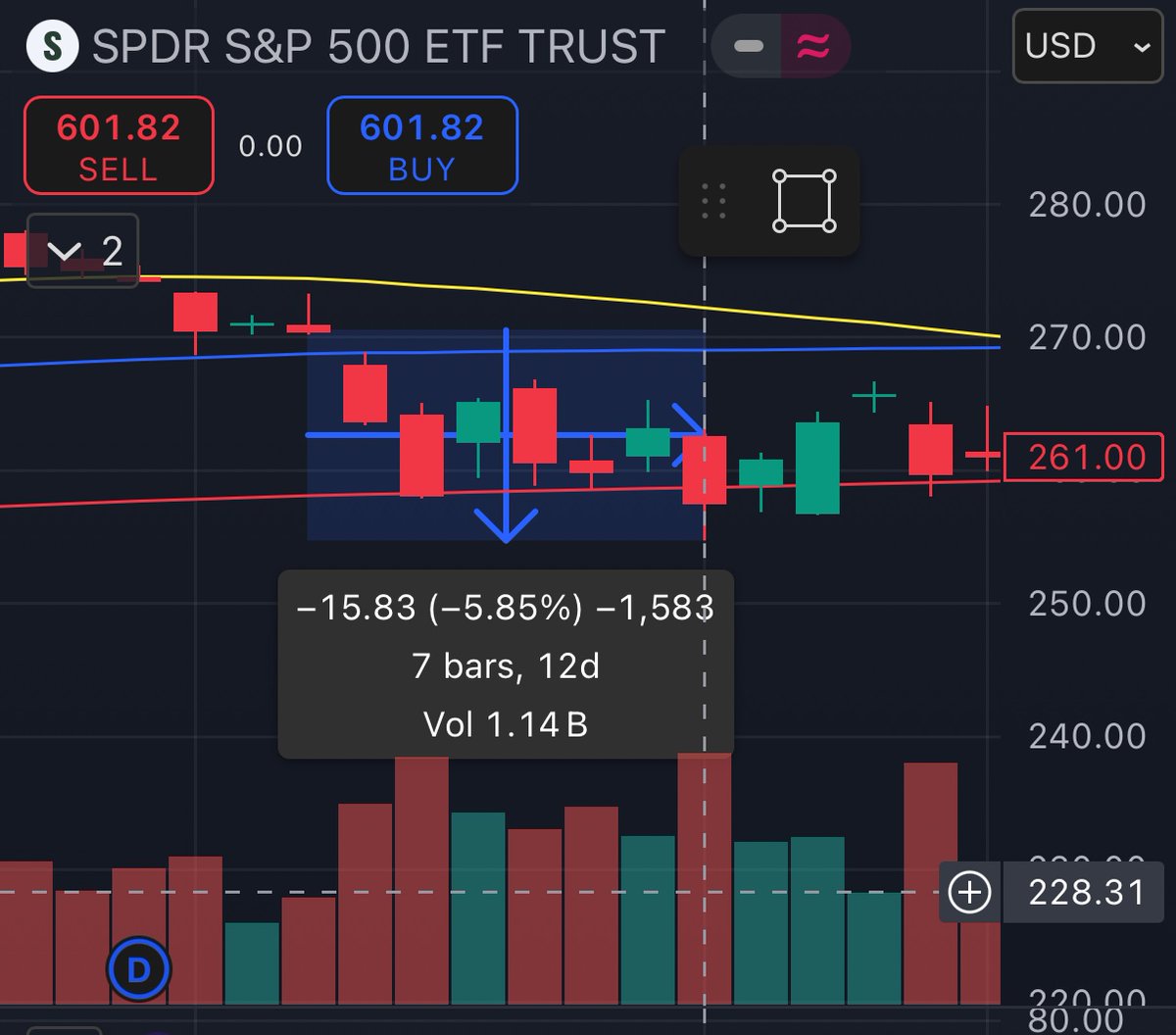

Impact of the market from March 22nd 2018, was as follows:

– $SPY, -5.8% over 12 days (to trough) – $BTC,

-28% over 14 days – $ETH,

-35% over 15 days

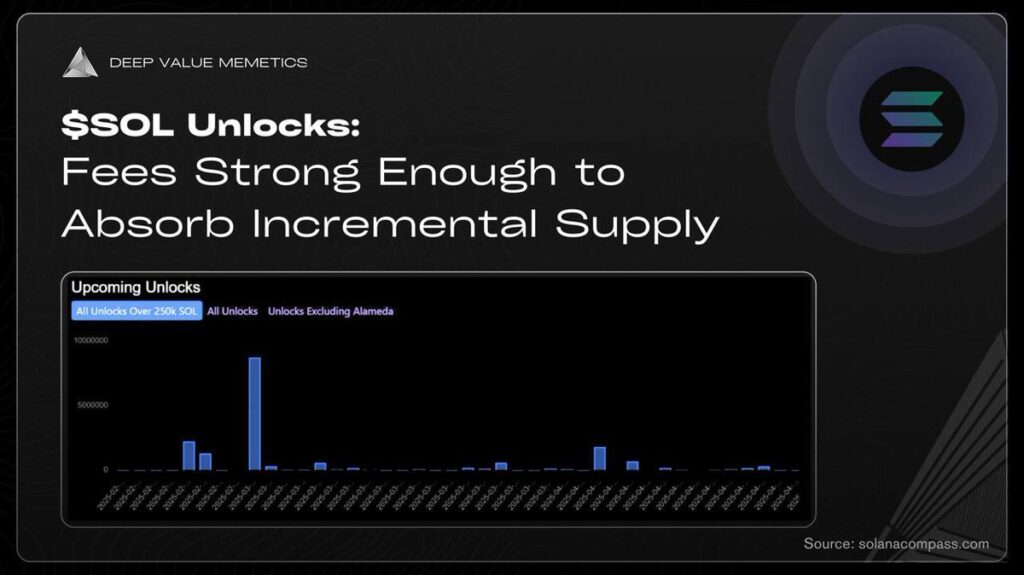

While we do believe the market has pulled-in a portion of the risk ($BTC already -9-10% off recent local $106k highs), given DeepSeek fears and short-term over bought conditions, we wanted to highlight prior performance given similar set-up around tariff fears. Currently, we are seeing on-going de-risking ahead of Monday’s market open.

For context, here are the events for 2018 vs. today’s:

March 2018 Tariffs:

– Steel and Aluminum: A 25% tariff on steel and 10% on aluminum imports from multiple countries, initially excluding some allies temporarily.

-Chinese Goods: Tariffs on $50 billion in goods from China, including semiconductors, machinery, vehicles, and parts, with initial implementation on $34 billion in July 2018, followed by $16 billion in August. Specific products included: Electronics like circuit boards and servers, Machinery parts, Motor vehicles and parts, Medical equipment

Current Tariffs (Trump Era, 2025):

-Steel and Aluminum: Continued tariffs from the 2018 policy, with additional tariffs on steel and aluminum from China, Russia, and others, affecting: Steel products like tubes, pipes, and sheets. Aluminum products including foil, sheets, and wire -From Canada and Mexico (Effective Feb 1, 2025): 25% tariff on all goods except for energy products from Canada at 10%. Specific products include: Maple syrup, lumber, aluminum from Canada, Fresh produce (tomatoes, avocados, bell peppers, cucumbers), dairy, cars, medications, beer from Mexico -From China (Effective Feb 1, 2025): 10% tariff on all products, expanding from the 2018 lists to encompass: Previously untaxed items like laptops, TVs, and other consumer electronics, Agricultural products, processed foods, and chemicals