DVM View: In the past few days $SOL and its ecosystem are underperforming given concerns about upcoming unlocks. We think selling pressure ahead of event will ultimately create attractive entries given: i/ incremental tokens will account for ~2.8% of supply; ii/ de minimis impact assuming 25% are sold over 60 days (.21% in incremental daily volume); iii/ 30d fees avg at ~$8m/day will help absorb impact and $SOL will re-price once potential selling abates; and iv/ $SOL’s Jan monthly fees are up 20x y/y.

Key Points:

– Solana’s current inflation economics are 4.715% per year (reducing 15% per year), on a linear unlocking schedule, which equates to 524,030 over 6 months, or 87,388/mo.

– Solana’s cirr supply is 488m (82%) with Fixed supply at 594m. The non-circulating represents locked in a stake account or owned by the Solana Foundation or Labs.

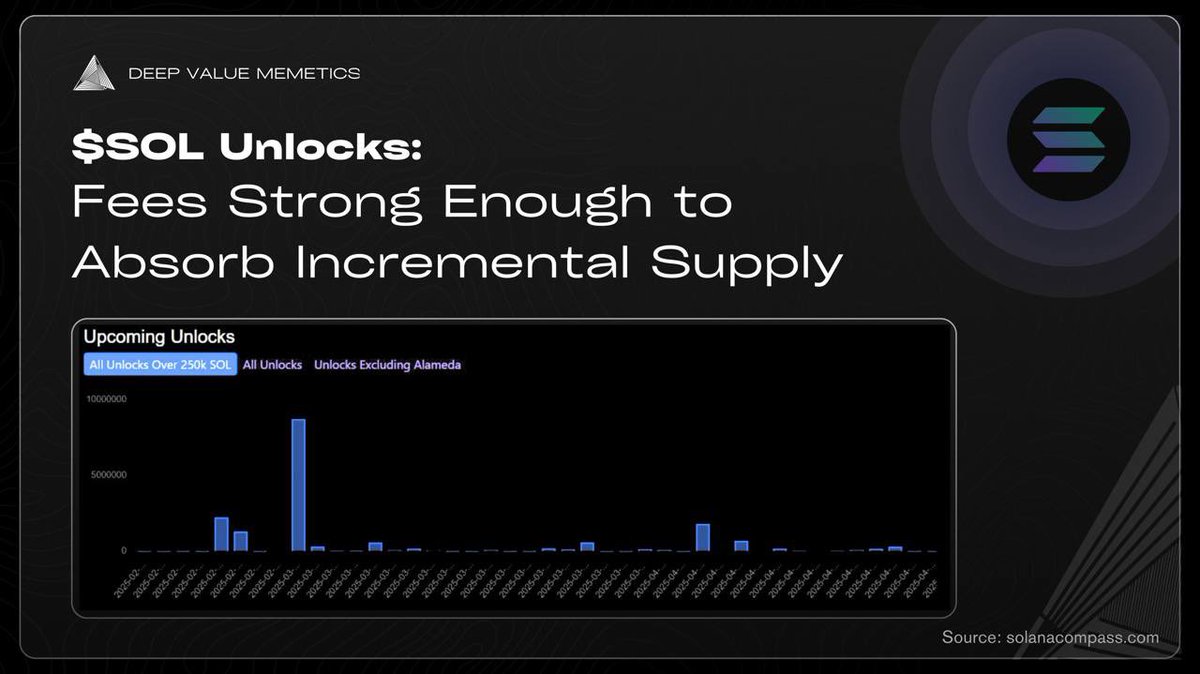

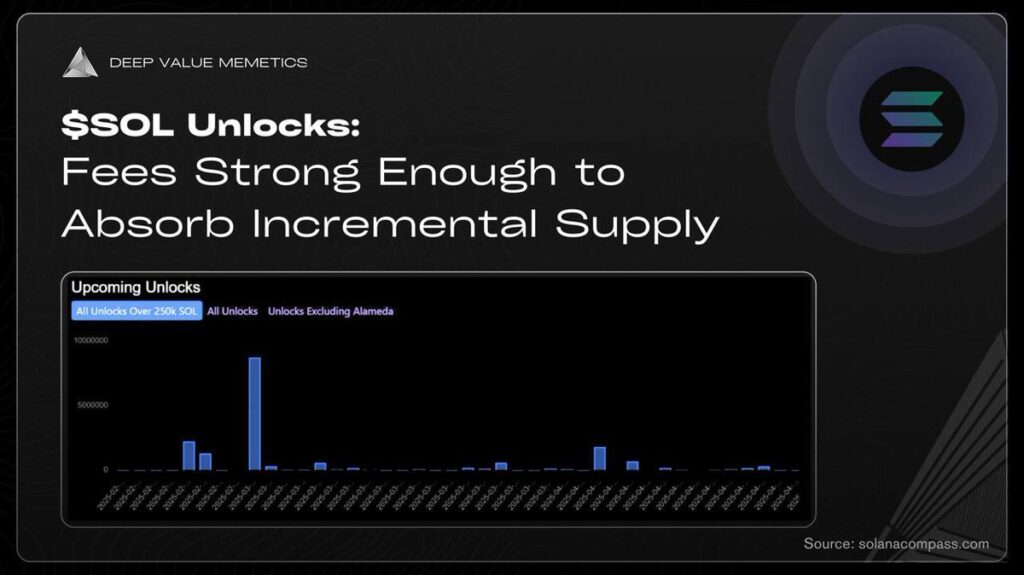

– Over the next 40 days, the largest incremental unlocking events are i/ 2,237,255 SOL on February 24th; ii/ 1,312,751 SOL on Feb 26th ; iii/ 8,734,373 SOL on March 1st ; iv/ 1,812,509 SOL on April 4th, according to @solanacompass.

– This would equate to a total of ~14m incremental tokens, which accounts for 2.87% of circulating supply.

– If we assumed 25% of the tokens were sold off in the market (not OTC) over 60 days, this would equate to $630m in total volume (assuming $180/$SOL).

– On a daily basis, using total volume over 60 days, this would represent $10.5m/day vs. the $5.09B/day average 30-day SOL volume, using @MessariCrypto data, accounting for an incremental 0.21%.

– During the unlocking window, total fees would be $333m (40 day period x $8.3m fees/d) which would be offset by incremental unlock value/Mcap of $630m (14m tokens x $180 $SOL price x 25%). However, after this period net fees would outstrip impact from incremental supply.

– Y/Y total monthly Solana fees have increased ~20x from $12m (Jan24) to $250m (Jan25). Consequently, we would not but too much weight on 2-3% increase in circulating supply.